As announced by Board on 23/03/2020, in order to minimize the

adverse effects of the COVID-19 pandemic on the financial markets

of our country, it was permitted under the second article of the

Board

Turkey

Finance and Banking

To print this article, all you need is to be registered or login on Mondaq.com.

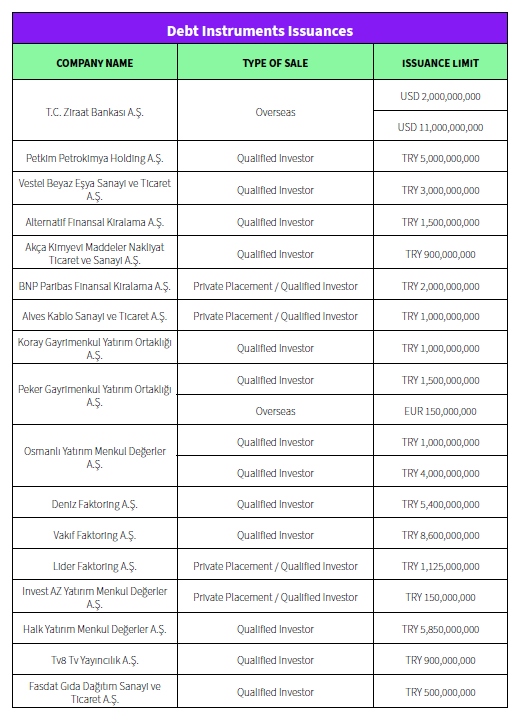

Issuances Approved by the Capital Markets Board of

Türki̇ye – December 2024

- Announcement Pursuant to the Board Decision No. 66/2035

and dated 26/12/2024

As announced by Board on 23/03/2020, in order to minimize the

adverse effects of the COVID-19 pandemic on the financial markets

of our country, it was permitted under the second article of the

Board Decision that communications through mobile applications

(e.g., WhatsApp) on the mobile phones of employees with remote

access in investment firms and/or personal email addresses assigned

to personnel could be used to accept orders until further notice,

effective from the date of the Board decision. Considering current

market conditions, the aforementioned provision under Article 2 of

the Board Decision dated 19/03/2020 has been repealed as of the

first business day following the date of this decision.

- Announcement Pursuant to the Board Decision No. 62/1863

and dated 05/12/2024

1) Pursuant to the Board’s decision dated 06/02/2023, the

short-selling ban imposed on equity markets within Borsa Istanbul

has been lifted, effective from 02/01/2025, limited to the equity

markets included in the BIST 50 Index as announced by Borsa

Istanbul.

2) In transactions executed in the equity markets where the

short-selling ban has been lifted, it has been decided to inform

investors and investment institutions that pressing the

“short-selling” button is mandatory for positions sold

without prior ownership and closed on the same day, in accordance

with Articles 24 and 28 of the Board’s Communiqué on

Margin Trading, Short Selling, and Lending and Borrowing

Transactions (Serial: V, No: 65).

- Announcement Pursuant to the Board Decision No. 66/2058

and dated 26/12/2024

The amounts subject to revaluation under the Capital Markets Law

No. 6362, as well as the regulations, communiqués, and other

subordinate legislation issued pursuant to this Law, along with

those issued under the repealed Capital Markets Law No. 2499 that

remain in force, have been published for the year 2025.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.