The Central Bank of the Republic of Türkiy (CBRT) released its November 2024 Market Participants Survey, revealing shifts in inflation and currency forecasts.

The survey, which included 68 representatives from the real and financial sectors, assessed expectations for inflation, exchange rates, interest rates and gross domestic product growth.

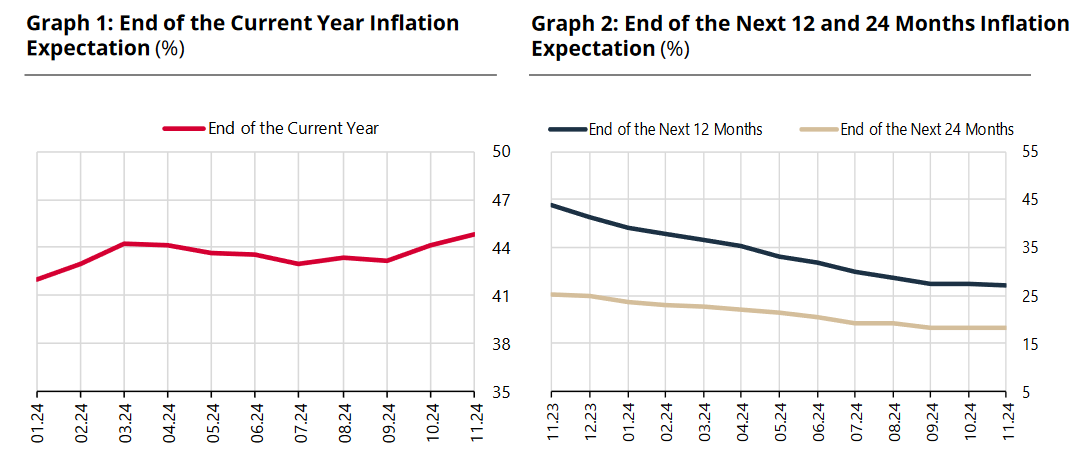

Inflation forecasts show mixed trends

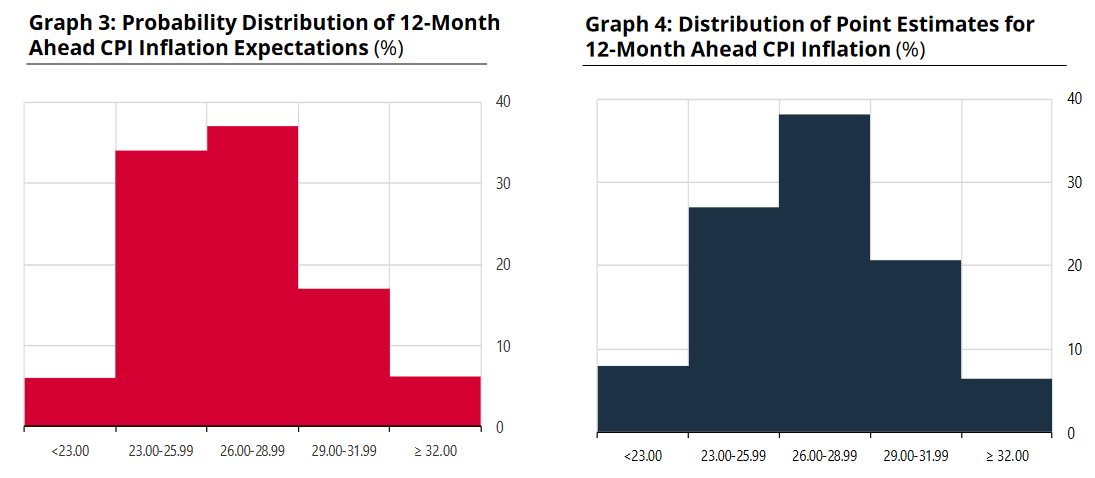

According to the survey, the year-end consumer inflation (CPI) expectation rose to 44.81%, up from 44.11% in the previous survey. However, the 12-month ahead CPI forecast showed a slight decline, falling from 27.44% to 27.2%.

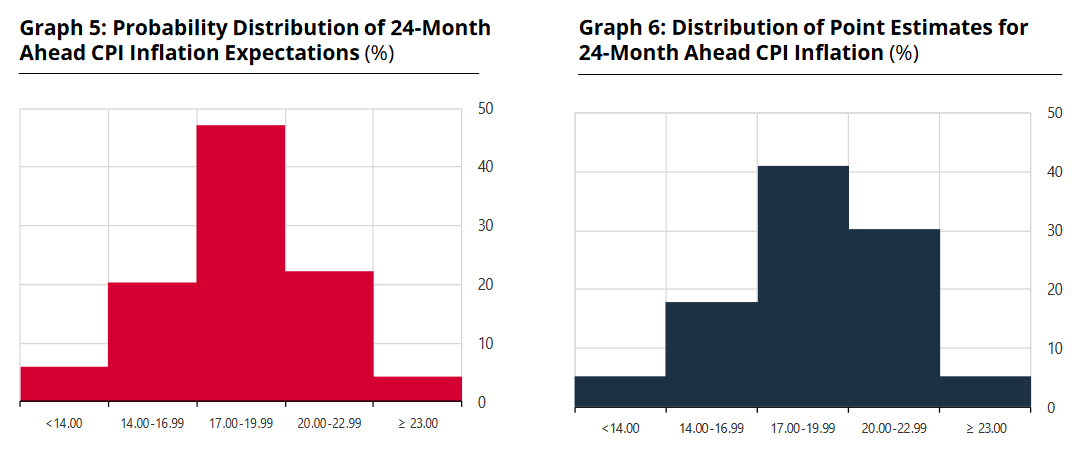

The 24-month inflation outlook increased slightly to 18.33% from 18.08%, indicating concerns over long-term inflationary pressures.

USD/TRY exchange rate expectations decrease

The survey showed a decrease in the year-end dollar-to-Turkish lira exchange rate forecast, revised down to ₺35.72 from the earlier estimate of ₺36.63.

In contrast, the 12-month exchange rate projection edged up marginally to ₺42.75 from ₺42.73, signaling slight adjustments in currency expectations.

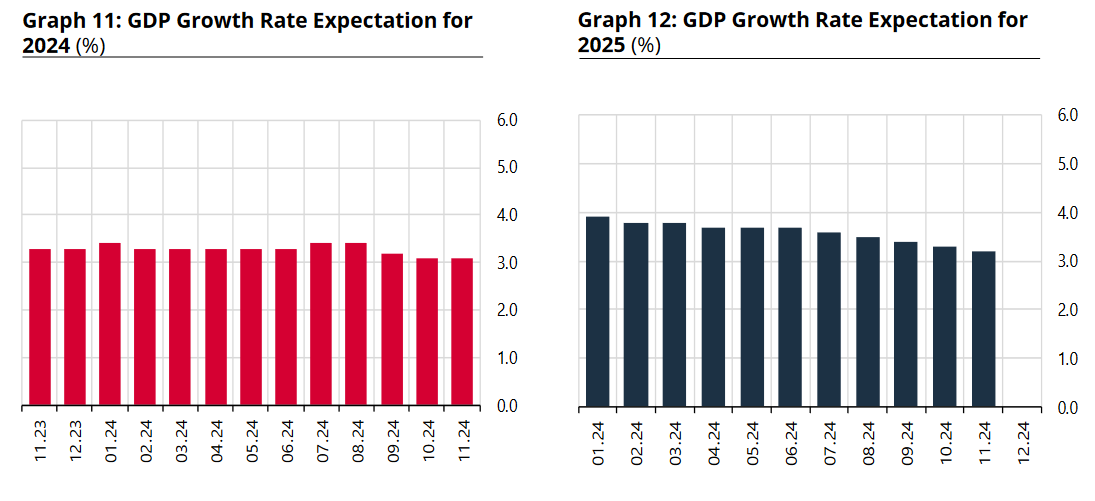

Interest rate and GDP growth projections remain stable

The central bank’s one-week repo rate expectation for the current month remained steady at 50%. The 12-month forward expectation declined to 30.84%, while the 24-month forecast dropped to 21.07%, suggesting a potential easing of interest rates in the future.

The GDP growth forecast for 2024 was maintained at 3.1%, while the 2025 growth expectation was slightly adjusted down to 3.2% from 3.3%.

The survey was conducted with 68 participants, including 51 representatives from the financial sector.